About Us

We deliver long-term value for our investors by fostering the creation of high-quality developments and communities. Our core strategy is to acquire land in the path of growth at below market prices, add value through entitlement and pre-development work, and then sell to homebuilders or developers at retail prices.

Emmerson Holdings believes that land delivers superior risk-adjusted returns and is unmatched in its ability to generate wealth. Land is unlike any other asset class in that it carries with it three inherent characteristics that allow for out-sized returns — 1.) there is a finite supply 2.) it is permanent and to a certain degree cannot be destroyed or taken, and 3.) all land is local, and therefore knowledge of land is highly specialized. Compare land to publicly-traded equities. Companies can issue new shares and dilute your ownership. Companies can declare bankruptcy and go out of business. Insider trading is of course illegal, and there are legions of analysts, experts and quantitative hedge funds who arbitrage away profitable trades so that they are not available for most investors. Land, on the other hand, is finite, will never go “out of business”, and will always present unique opportunities for local investors.

Emmerson Holdings forms investment partnerships to acquire land in the path of growth at below market prices, add value through entitlement and pre-development work, and then sell to homebuilders or developers at retail prices. The principals of Emmerson Holdings nearly always invest alongside its investors — a tight-knit network of family, friends and partners. Not only do we believe that it is important to have “skin the game”, but also we have a low-fee structure that incentives us to only pursue deals with an expected annual return of over 20%. Although there is incredible pent-up demand for housing in the Phoenix area, unentitled land appears to be undervalued and there is a shortage of platted & engineered lots available for needed new housing. If you are an accredited investor with an interest in land investment, we would love to meet you.

History

The principals of Emmerson Holdings, Craig Emmerson and Chase Emmerson, have been actively involved in Arizona land investment for a combined total of over 40 years.

Principals

CRAIG EMMERSON

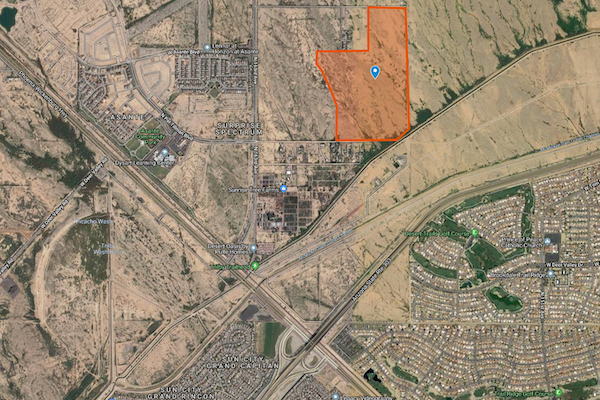

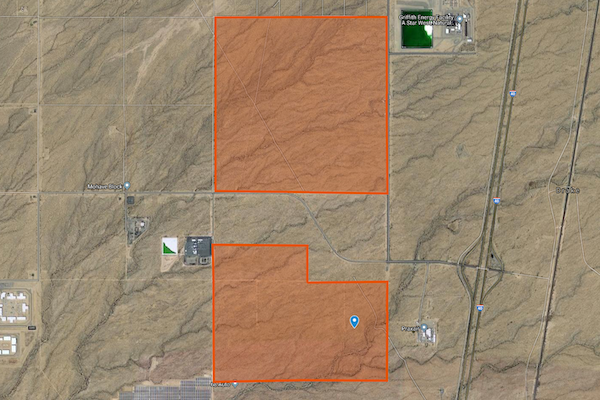

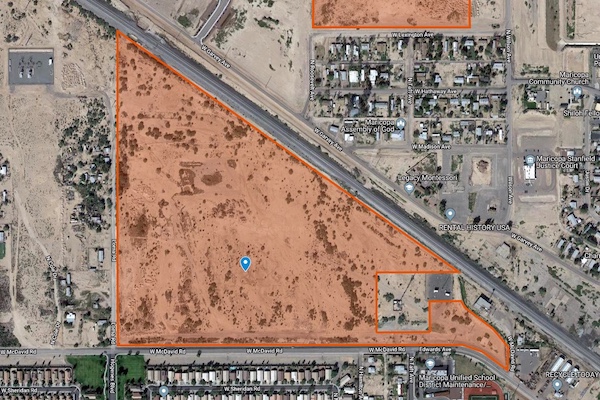

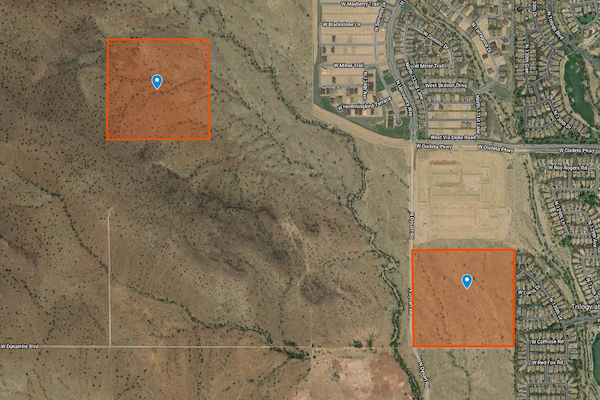

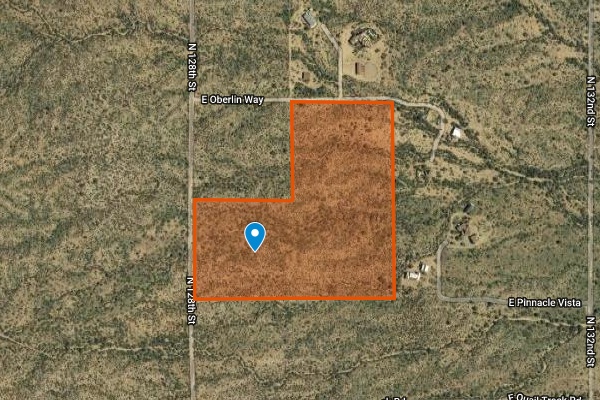

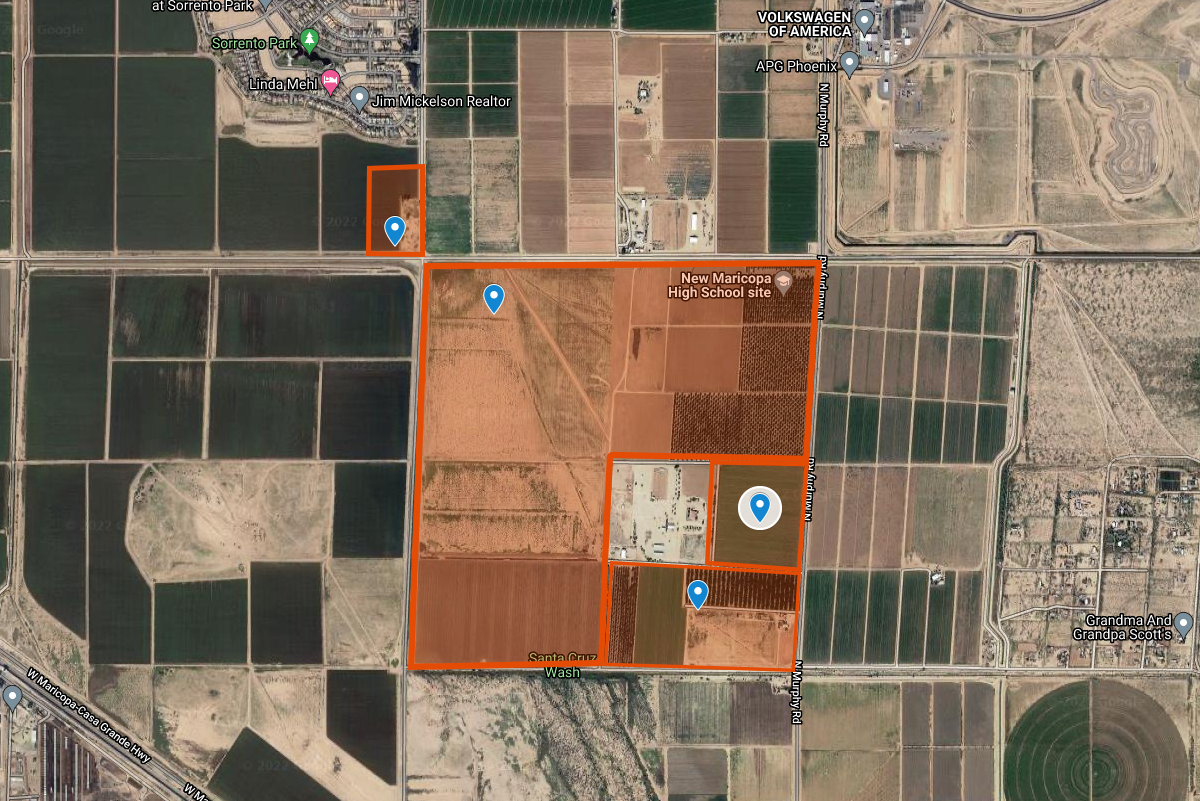

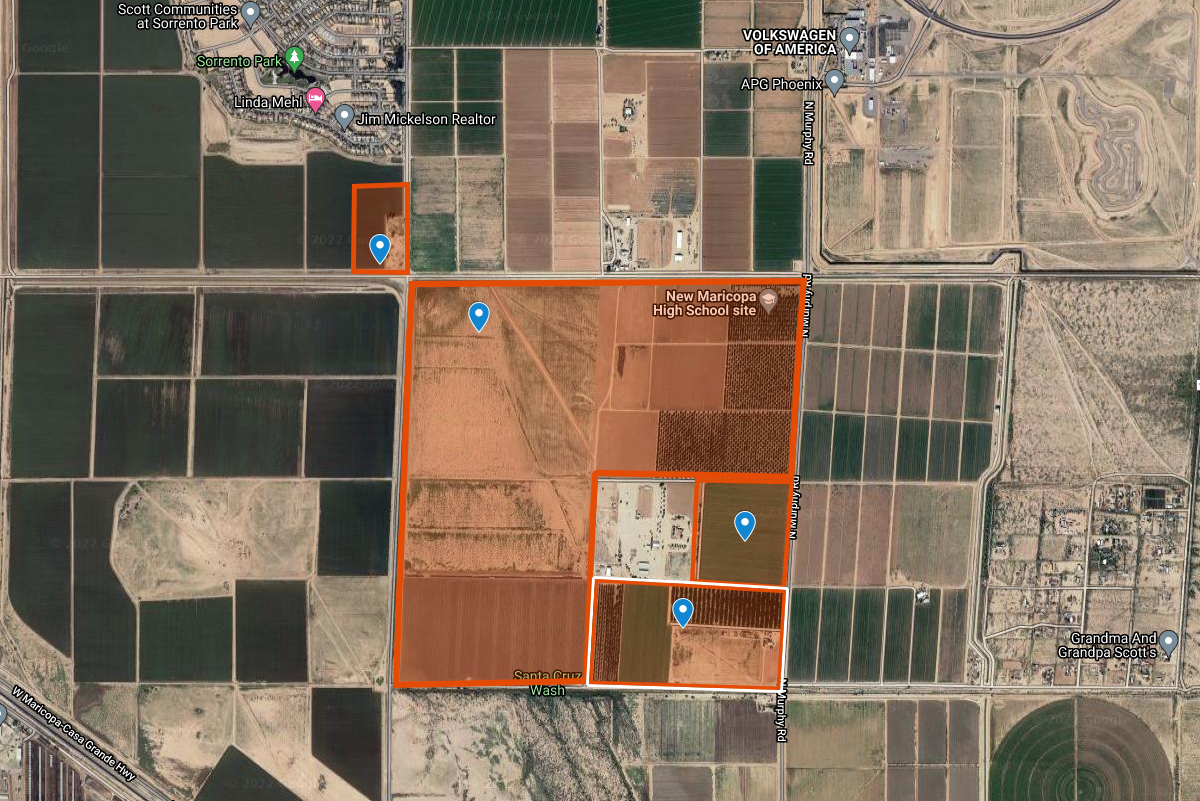

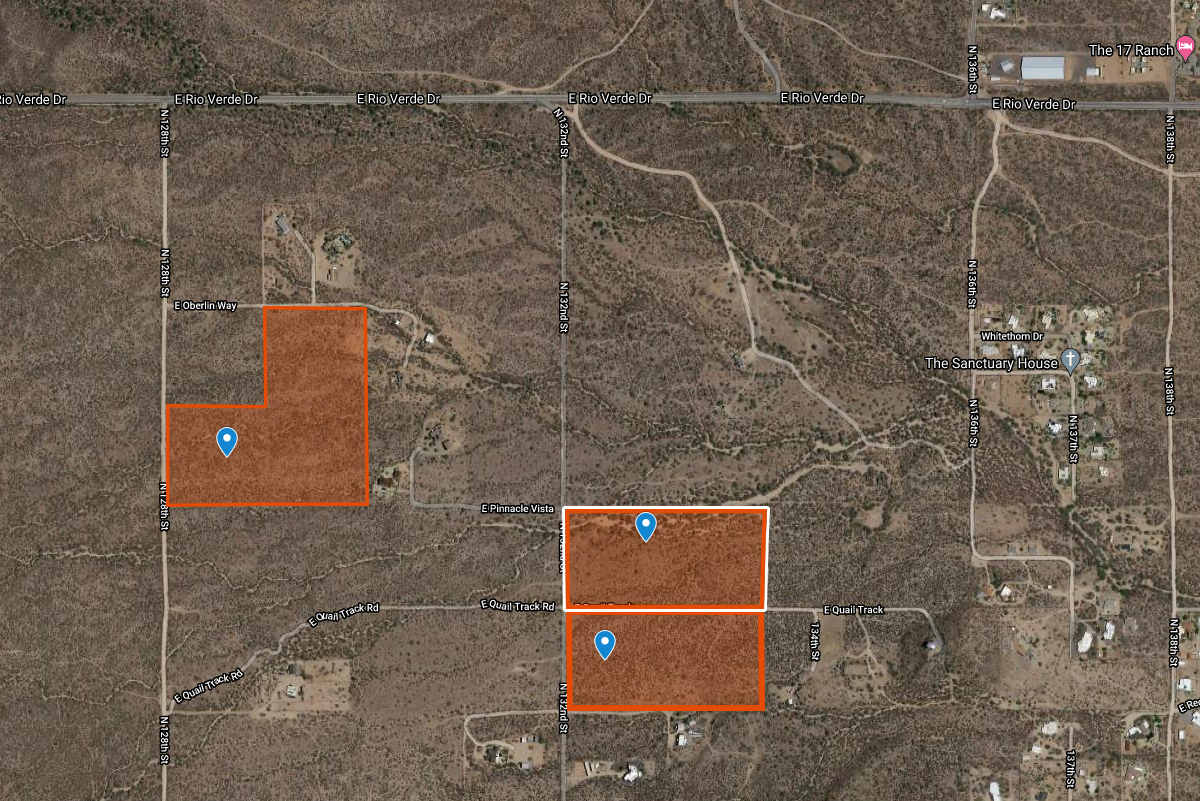

Craig Emmerson is a Partner at Emmerson Holdings and is also the designated broker of Emmerson Enterprises, Inc. He earned an undergraduate degree and his MBA from Arizona State University. In the early 1980’s, Craig founded former company Emmerson Realty, Inc. — a residential real estate brokerage firm with over 10 salespeople. Craig has been active in land investment throughout Arizona for decades, most frequently in Scottsdale, Rio Verde Foothills, Kingman, the City of Maricopa, the Sonoita/Elgin area, Wickenburg, Gilbert, Buckeye/Tonopah, and Surprise. By acquiring, holding, entitling and often times final engineering strategic parcels in the path of growth, Craig has fostered the creation of several high-quality master-planned communities (MPC’s) in the Metro Phoenix Area – most recently Storyrock (a 462-acre future MPC in North Scottsdale with approval for 443 homes), Anderson Russell (a 776-acre future MPC in the City of Maricopa with approval for over 3,000 homes), and Altamira (a 178-acre future MPC in Surprise slated for 445 homes).

You can also follow him on:

480.368.5205

CHASE EMMERSON

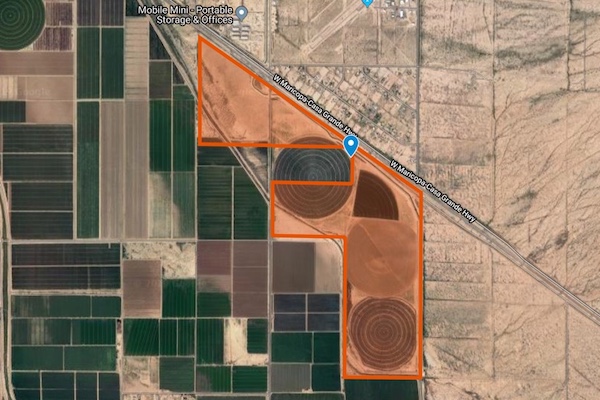

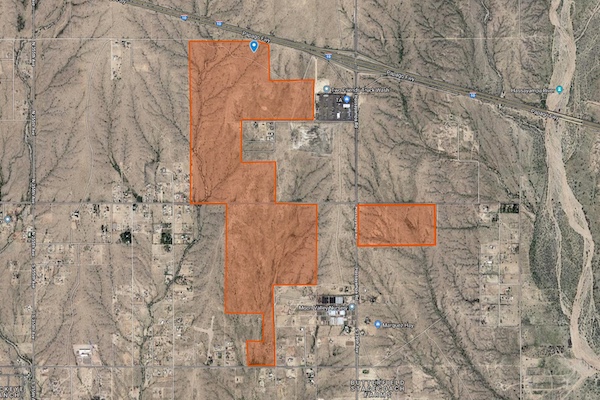

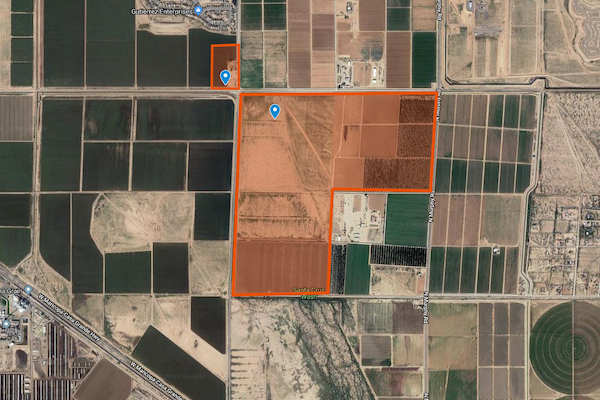

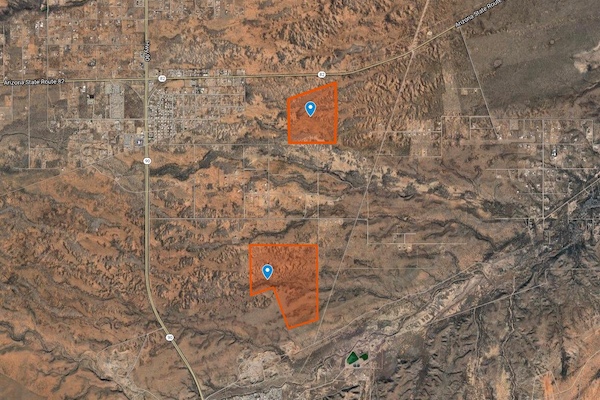

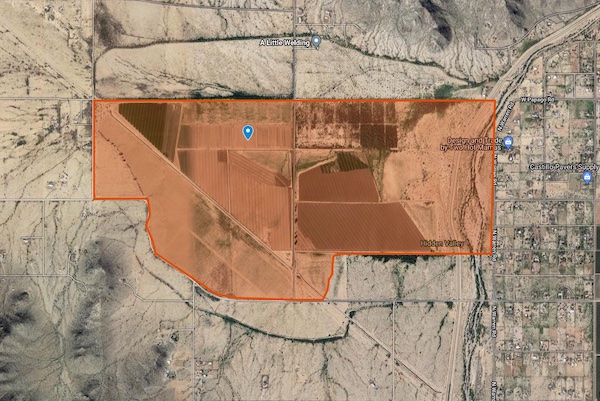

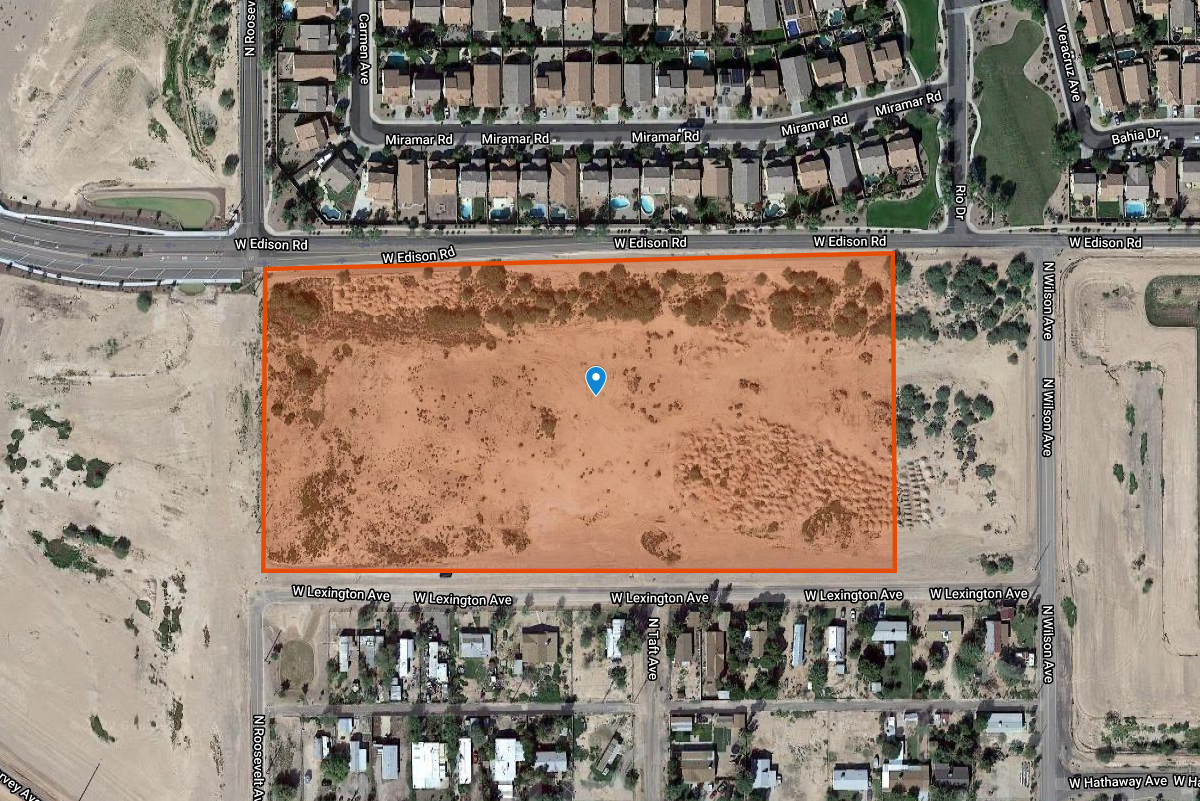

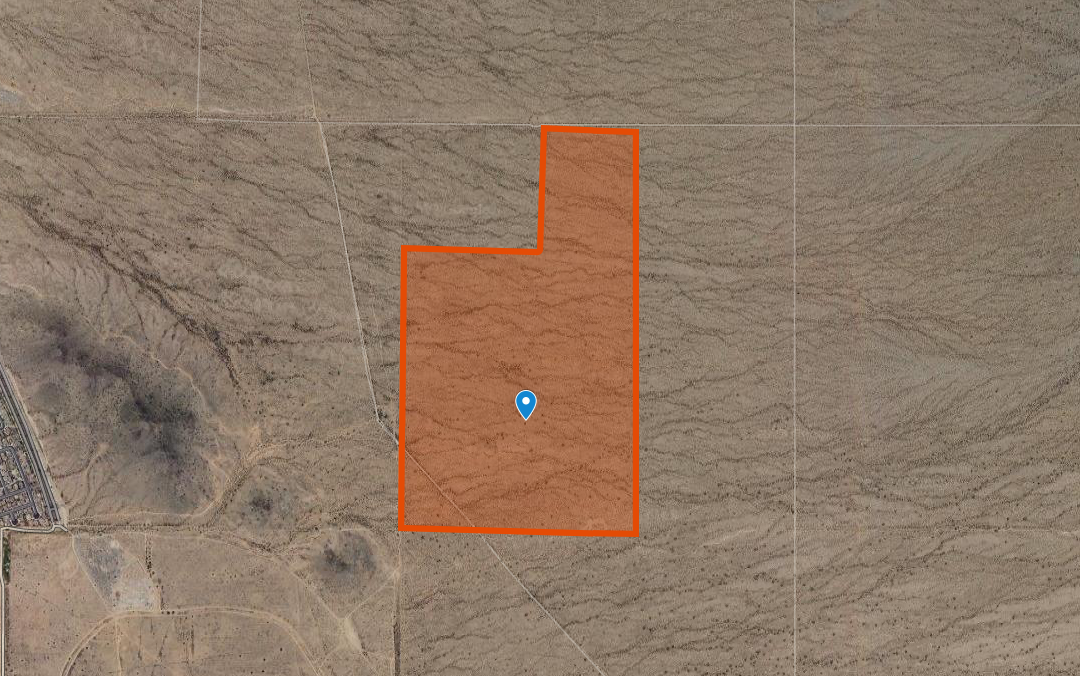

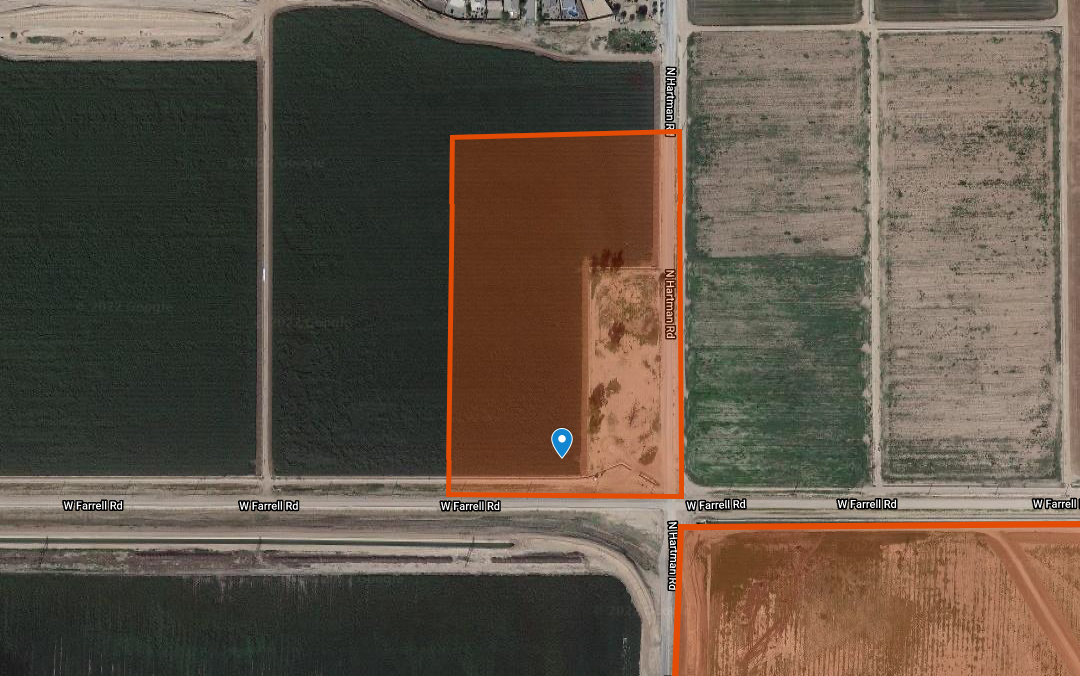

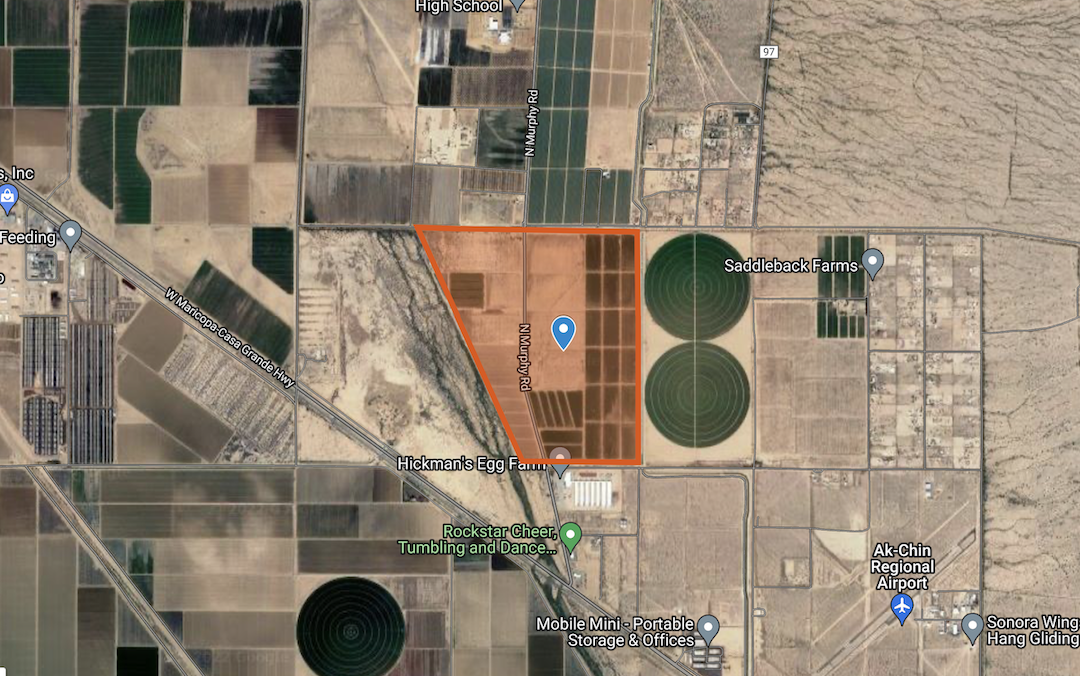

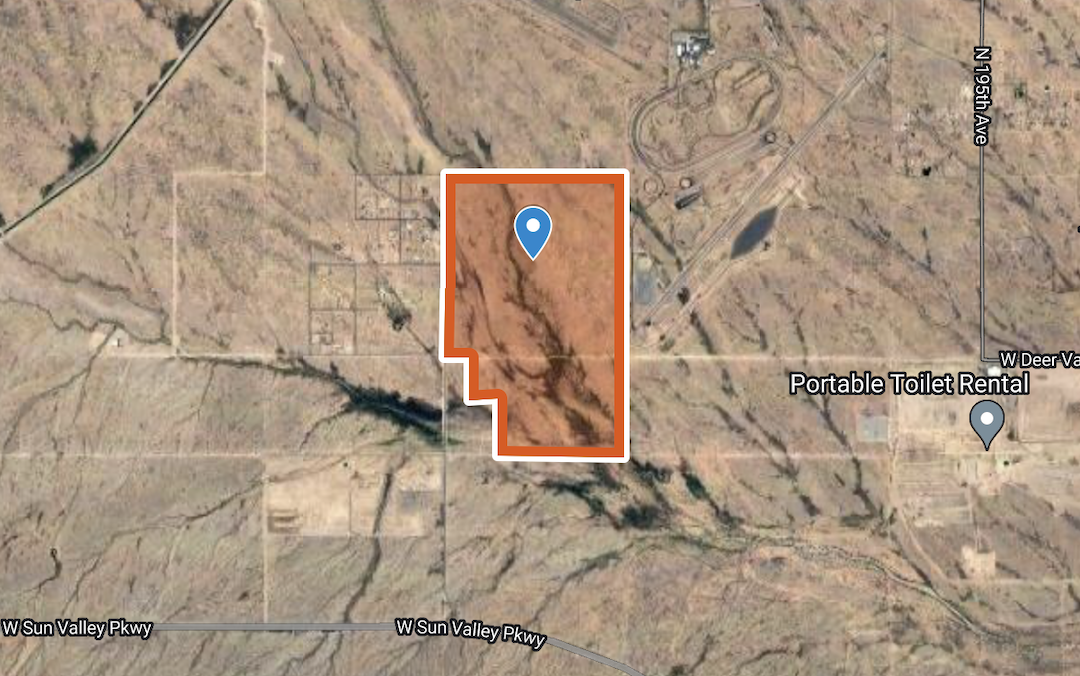

Chase Emmerson is a Partner at Emmerson Holdings and is active in new acquisitions, dispositions and management of existing land holdings. Chase has formed several land investment partnerships, most recently in North Scottsdale, Tonopah/Buckeye, Goodyear, unincorporated Pinal County, Surprise, and the City of Maricopa. Recent acquisitions include Maricopa 480 ($21M+/-), Hidden Valley Ranch ($12.5M+/-) and Desert Trails ($10.25M+/-). Chase earned an undergraduate degree in Business with a focus on Real Estate from the University of Southern California and a master’s degree from Columbia University, where he focused on International Finance. Having previously worked as a Senior Consultant at a boutique management consulting and private equity firm in New York, he brings a hands-on and analytical approach to land investment. Chase recently served as the Treasurer for the Scottsdale Active 20/30 Foundation, benefitting local children’s charities.

You can also follow him on:

602.315.9988

Some of our Partners Include

Why Arizona Land

Unique Benefits of Land Investment

- Few capable buyers and an illiquid market often leads to the “mispricing” of land, and thus great buying opportunities.

- Specialized knowledge allows for the opportunity to leverage an informational advantage.

- Land allows for the opportunity to leverage a specialized skillset and key relationships to add value through rezoning, entitlement and engineering work.

- Land offers diversification to your portfolio, often times offering a low level of correlation to other investments.

- Land has historically been a great hedge against rising inflation.

- Given its illiquidity and low carrying costs, land investors are less prone to “panicked selling” than investors in many other asset classes.

- The supply of land is finite, and demand is rising….

- “Buy land, they’re not making it anymore.” – Mark Twain

- “Land monopoly is not only monopoly, but it is by far the greatest of monopolies; it is a perpetual monopoly, and it is the mother of all other forms of monopoly.” – Winston Churchill

- Land has long track record of generating and preserving wealth over the long-term…

- “The major fortunes in America have been made in land.” – John D. Rockefeller

- “Buy land on the fringe and wait. Buy land near a growing city! Buy real estate when other people want to sell. Hold what you buy!” – John Jacob Astor

Do you have enough land in your portfolio?

In 1952 Harry Markowitz founded “Modern Portfolio Theory”, and since then it has served as a cornerstone of modern finance and financial planning. According to Modern Portfolio Theory, investors should hold what is called the “Market Portfolio” in order to maximize their returns while also minimizing risk through diversification. Every investor should hold the same Market Portfolio, and depending on each individual investor’s risk tolerance he or she should just hold more or less of a “risk free asset” such as cash or U.S. Treasury bills (or even utilize leverage if they have a high risk tolerance). The optimal Market Portfolio is said to be a basket of all investable assets, with the weighting of each asset determined by its value relative to the total value of all investable assets. Therefore, if the total value of Amazon’s shares were equal to 1% of all of the investable assets in the world, the theory goes that an investor should have 1% of their portfolio in shares of Amazon. The key rationale for holding the Market Portfolio is diversification – which is known as the only “free lunch” when it comes to investing since it allows for higher returns with lower risk. Most financial planners consider Modern Portfolio Theory when creating portfolios for their clients, which is where the common investing phrases “overweight” or “underweight” originate… Investors and financial planners decide to marginally increase or decrease the exposure to an individual asset relative to its equal weighting. Needless to say, most investors do not hold the Market Portfolio, or an approximation of it, even though this generally leads to lower returns and more risk. Most people own far too much stock in their own company’s shares, far too much stock in their own country (vs. emerging markets, for example), and…not enough land!

As of September 30, 2022, the Federal Reserve estimated that the total value of all privately-held land in the United States was $25 trillion, and the total market cap of the S&P 500 Index at that time was approximately $30 trillion. According to Modern Portfolio Theory, if an investor has a balanced portfolio with $10,000,000 invested in the S&P 500, then they should also have $8,333,000 invested in U.S. land (because the value of all privately held land in the U.S. is estimated to be 83% of the total market cap of the S&P 500). Most investors only investment in land is their home — more specifically, the lot on which their home was built. So if an investor has $10M invested in the S&P 500, and also owns a home on a lot that is worth $1M, then they should add $7.33M in land to their portfolio to have a balanced weighting between land ($8.33M) and S&P 500 stocks ($10M). Again, the key rationale for holding the Market Portfolio is that it can help achieve higher returns with lower overall risk. When the stock market zigs, land can zag — in some cases offering protection to your portfolio from downside risk as well as outsized returns. Land is an important asset class that should play a part in the portfolios of most high net worth investors.

How to build your land portfolio

Diversification within your land investments is another good idea. If that same investor has $7.33M to invest in land, ideally they should spread it around a few different investments rather than put all their eggs into one basket. There are a couple of challenges, however…The most lucrative land investments are generally larger deals, since fewer capable buyers for large deals typically equates to better buying opportunities, and larger parcels allow for economies of scale in planning and entitlements. Another challenge facing most investors is a lack of specialized knowledge, time and relationships needed to identify, acquire, entitle, engineer and sell land. Land investment partnerships solve these two challenges — giving investors an opportunity to diversify their land investments among several large (and typically more lucrative) deals and enabling them to leverage the specialized knowledge, time and relationships of the land investment manager.

How to pick a land investment manager

When picking the land investment manager, it is important to look at their track record, their fee structure, and their integrity. Have they delivered attractive returns through various market cycles? Do they offer low fees and a deal structure that aligns the manager’s interests with those of the investors? Are their investors and partners sophisticated and would they speak to the investment manager’s integrity? Emmerson Holdings checks all 3 of these boxes. We have a track record of delivering outsized returns. Also, by design our interests are closely aligned with those of our investors. We nearly always invest our own capital into each of our investments, and our low fee / high return threshold structure incentivizes us to only pursue deals with an expected annual return in excess of 20%. Our long-time and tight-knit group of investors (consisting of family, friends and business partners – most with accomplished careers in real estate, law and business) is a testament to our integrity. We operate based on the belief that reputation is something that is difficult to build but easy to lose.

Why Arizona

Arizona, and specifically the Greater Phoenix Metro Area, has enjoyed some of the strongest job and population growth in the entire country. The outlook over the next 10+ years is equally as positive. The data on Arizona and specifically Greater Metro Phoenix (incl. Maricopa & Pinal Counties) makes a compelling case for investments in land and housing.

Population Statistics:

- In 2021, Maricopa County had the highest net domestic migration of any county in the U.S. (Source: U.S. Census)

- In 2021, Arizona had the 4th highest population growth of any state driven by in-bound migration (Source: U.S. Census)

Economic Statistics:

- Arizona added over 100,000 jobs in 2022 (U.S. Bureau of Labor Statistics – 2022).

- Arizona ranks tenth in the U.S. for personal income growth in 2021 (U.S. Bureau of Economic Analysis – 2022).

- In 2021, the Arizona Commerce Authority welcomed 106 new business operations to the State of Arizona, generating capital investment of over $24B and the creation of 24,000+ total jobs (Arizona Commerce Authority).

Housing Statistics:

- Based on the number of new permits, Greater Phoenix has the largest housing market in the U.S. — tied with Atlanta (John Burns Consulting – 2021)

- Phoenix continues to offer relative affordability relative to other major metro areas. In 2021, the median single-family home price in Greater Phoenix was less than nearly all other major West Coast & Mountain West metros including Denver, Salt Lake City, Los Angeles, Reno, Austin and Boise (National Association of Realtors).

Portfolio

- All

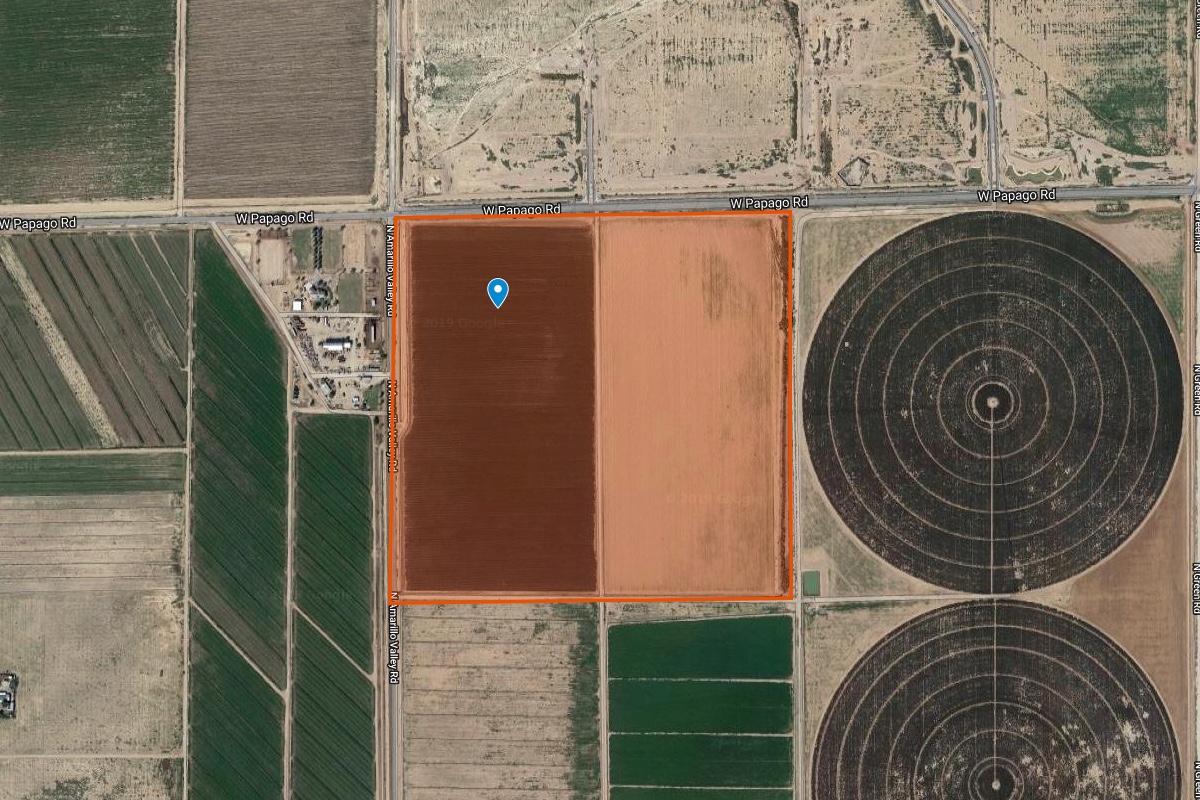

- Casa Grande, AZ

- City of Maricopa, AZ

- Cochise County, AZ

- Dragoon, AZ

- Fountain Hills, AZ

- Goodyear, AZ

- Hauchuca City, AZ

- Maricopa County, AZ

- Mohave County, AZ

- Peoria, AZ

- Pinal County, AZ

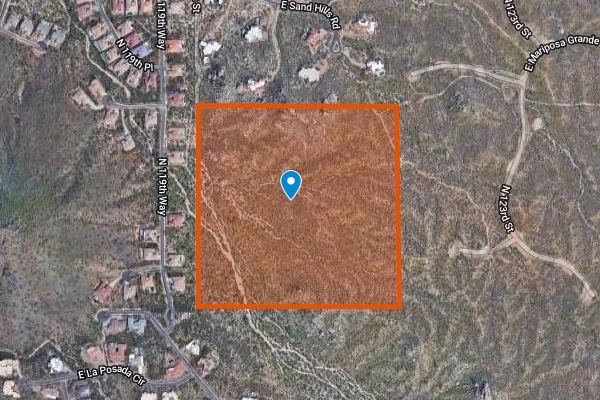

- Scottsdale, AZ

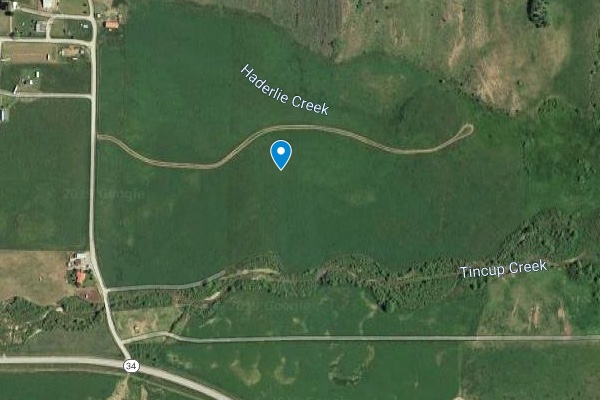

- Star Valley, ID

- Surprise, AZ

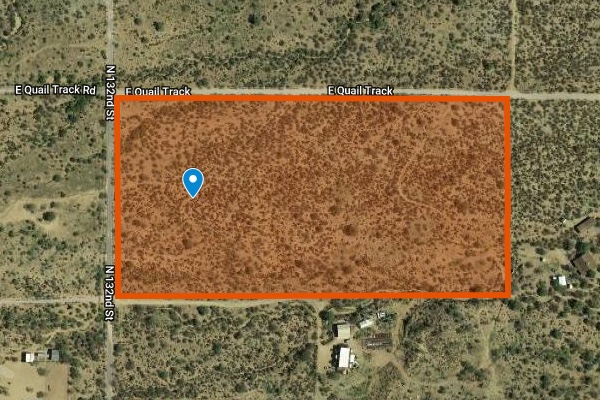

- Tonopah, AZ

- Wilcox, AZ